advice you can trust.

& Planning - All Here.

Why Us

You are your own financial hero – for you, your family, and your community. The burden to make the right financial choices is heavy. Fortunately, you don’t have to go it alone.

The advisors at Frazier Financial have lived and worked in our community for over 40 years, investing our money in the same places we recommend to our clients. We are proud to serve you and treat you like family, combining our extensive financial credentials with a personal relationship. We can be your “one–stop–shop” resource for all your financial needs.

What We Do

Wealth Management & Tax Preparation

Taxes comprise an essential piece of your complete financial picture. As your strategic partner in developing a comprehensive tax plan, we will help you reduce your tax burden and maximize cash flow.

Investment Management

Retirement Plan Options

Business Tax

Tax Preparation

Education Savings

Life, Disability & LTC Insurance Protection

Financial Planning

Tax Planning

Estate, Gift and Trust Tax Services

Retirement Planning

Business Structure Planning

Estate Planning

Process

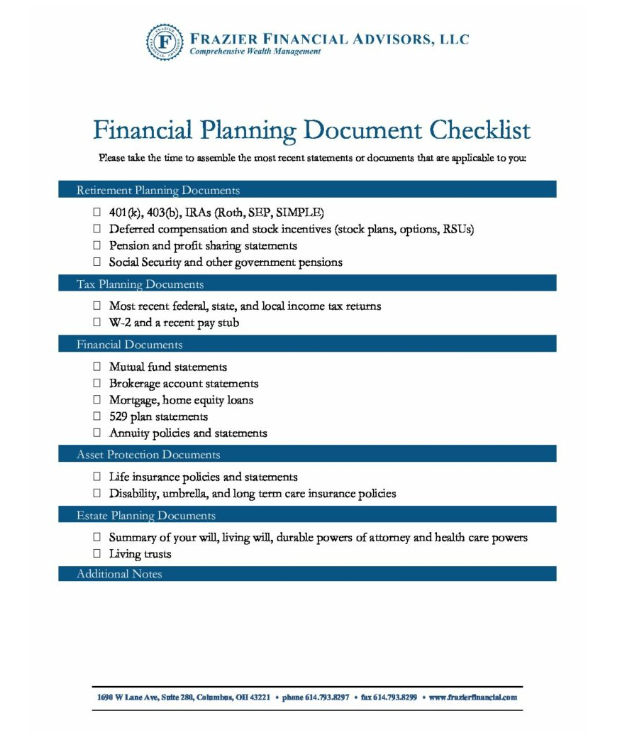

Schedule a Visit

Come spend a couple of hours at our office, where we will get to know each other, share expectations, and gather information for the next visit. You will meet one of our office dogs, Romeo or Beans, depending on who is scheduled to work that day.

Discuss Solutions

During our second visit, we will share a comprehensive conversation about how to best meet your financial goals.

Implement Your Plan

Rest assured we will provide the successful financial relationship you are looking for and deserve.

Relationship for a Lifetime

We’re committed to helping you achieve your financial goals. We’re looking forward to having your family become part of our family on your financial journey.

You have worked hard to get where you are today.

You’re faced with challenging financial decisions that impact your ability to care for loved ones and maximize what you have earned. Do you have a trusted guide on the path to achieving your goals?

Our History

1984

Income Tax Preparation

1984

1993

Investment Advisory Services

1993

1997

Wealth Management Services

1997

2013

$50 Million of Investment Profits for Clients

2013

2019

$100 Million of Investment Profits for Clients

2019

2020

Financial Advisor Magazine’s “Top 50 Fastest Growing Firms in 2021” RIA Ranking, and Fastest Growing RIA Firm in Ohio

2020

2021

$200 Million of Investment Profits for Clients

2021

Complimentary Visit

Fill out the form below to schedule a visit with us.

The first step in any relationship is getting to know one another. Solid relationships are built on trust and communication. Schedule a time to meet with one of our financial advisors to determine whether we are the right fit for your needs. We look forward to meeting you.